Buying a house is one of the most important and life-changing decisions in a person’s life. Whether you purchase the house to make it your home or for investment, it requires a careful selection of a Home Loan Partner or lender. A Home Loan is a type of a secured loan, in which the property to be purchased, constructed, or renovated is pledged as collateral security with the Bank / Lender. loan Broker.in has simplified the home loan process and made it easier than ever before for you to own your dream home.

Home Loan Features:

Purpose:

Purpose:

♦ Ready-to-move Flats / Apartments / Floors / Bungalows

♦ Under-construction Flats / Apartments / Floors / Bungalows

♦ Vacant Plot of land

♦ Home Improvements

♦ Home Construction / Extension

♦ Office Premises / Commercial

Maximum Loan Amount:

♦ Upto 30 lacs: Upto 90% of Cost of Property

♦ From 31 lacs - 75 lacs: Upto 80% of Cost of Property

♦ More than 75 lacs: Upto 75% of Cost of Property

The above is subject to income repayment capacity of the Borrowers

Maximum Term:

♦ Upto 30 years Mortgage Home Loans are available depending on various Bank Policies subject to the retirement age.

Applicant and Co-applicant to the loan:

♦ Home Loans can be applied for either Individually or jointly.

♦ All Proposed owners of the property will have to join as co-applicants.

Home Loan Eligibility:

Click here to quickly check your Home Loan Eligibility....

Click here to quickly check your Home Loan Eligibility....

Home loan eligibility depends upon various factors. A few of them are listed below:

Income:

♦ Your income determines the amount of loan you are eligible for. Banks generally keep an EMI to Income ratio at 45% to 60%.

For Salaried profile customers, current monthly salary is considered.

For Self-employed profile customers, income shown in Annual Income tax returns is usually considered. There are other income eligibility calculation methods also like Gross Turnover, Banking Surrogate, Existing EMI track record, GST method and so on.

Property Cost & Market Value:

♦ Lower of the Property cost or Market Value is taken by Banks for calculating maximum loan amount.

♦ Higher the home loan amount, lower the percentage of funding available as per RBI norms as follows:

|

Home Loan Amt. |

Maximum Funding |

|

Upto 30 lacs: |

Upto 90% of Cost of Property / Property Market Value |

|

From 31 - 75 lacs: |

Upto 80% of Cost of Property / Property Market Value |

|

More than 75 lacs: |

Upto 75% of Cost of Property / Property Market Value |

Tenure of the loan:

♦ The longer the tenure you opt for, the more loan you are eligible for as the EMI amount decreases with increase in tenure.

Interest rate offered:

♦ If your interest rates are on a lower side, then the home loan eligibility will be higher and vice-versa as the EMI amount decreases with decrease in interest rate

Existing Loans:

♦ In case you are paying EMIs on existing loans, then the home loan eligibility amount will come down to keep the EMI to income ratio at 45% to 60%.

Credit History:

♦ Banks also check credit history of a borrower from CIBIL which stands for Credit Information Bureau India Ltd. It is a repository of information, which contains the credit history of commercial and consumer borrowers. CIBIL provides this information to its members in the form of credit information reports. Individuals can also access their own credit reports from CIBIL. For more information refer www.cibil.com. Generally a Credit Score of 700 & above is considered GOOD. Many Banks these days are following CIBIL Score based Interest Rates, which means: -

Better your CIBIL Score, Better Interest Rate you will get!

A home loan borrower enjoys Multiple Tax Benefits on both Interest and Principal repayment under the following sections of Income Tax:

A home loan borrower enjoys Multiple Tax Benefits on both Interest and Principal repayment under the following sections of Income Tax:

|

S.No. |

IT Act Section |

Principal / Interest |

Maximum Amount |

|

1. |

Sector-24(d) |

Interest |

2,00,000 |

|

2. |

Sector-80C |

Principal |

1,50,000 |

|

3. |

Sector-80EEA |

Interest |

150,000 |

1. Deduction for Interest Paid - Under Section 24(d) - Upto Rs.2,00,000/-

♦ For Self-occupied house property, the interest paid for the year can be claimed as a deduction from your total income up to a maximum of Rs.2,00,000/- under Section 24(d).

♦ For Let-out property, although there is no upper limit for claiming interest against the rental income, However, the overall loss under the head of House Property is restricted to Rs.2,00,000/- only.

♦ This Deduction can be claimed from the year in which construction of the house is completed.

What about the Interest paid on the home loan of an under-construction property?

Supposing, you bought an under-construction property which is yet to be ready and you are paying interest / EMIs on the home loan you’ve taken. In this case, you can get tax deduction only after completion of construction of property. The interest paid during this under-construction period gets added and can be claimed equally in the next 5 years starting from the year the property gets completed. You can also add to this the interest you would be paying on the running home loan after the completion of property. However, the maximum deduction is limited to Rs.2,00,000/- only.

2. Deduction on Principal repayment - Under Section 80C - Upto Rs.150,000/-

♦ The Principal portion of the EMI is also allowed as deduction under Section 80C along with other tax saving investments like PPF, Life Insurance premium etc. However, the overall limit u/s 80C remains Rs.150,000/-.

♦ Also you can claim a deduction for stamp duty and registration charges paid once only during the year of purchase of property. However as mentioned above, the over can also be claimed u/s 80C but within the overall limit of Rs .1.5 lakhs. However, the overall limit u/s 80C remains Rs.150,000/- for all such expenses and investments.

♦ Another condition is that the house property should not be sold within 5 years of possession, else the deduction claimed earlier will be added back to your income in the year of sale.

3. Additional Deduction for Interest Paid - Under section 80EEA - Upto Rs.150,000/-

Budget of 2019 has also introduced additional deduction of interest u/s 80EEA for first time home buyers up to maximum Rs 1,50,000 under these conditions:

♦ Stamp value of the property should not exceed Rs.45 lacs

♦ Home Loan should be sanctioned between 1st April’19 to 31st March’20

♦ You should not own any other house property in India.

What happens in Joint Home Loans? Does each Borrower get benefits?

Yes. If there are multiple borrowers in the Home Loan, each of the borrowers are eligible for each of the 3 deductions of interest and principal repayment as explained above in their respective income tax returns. However, the borrower should also be a co-owner in the property purchased on loan.

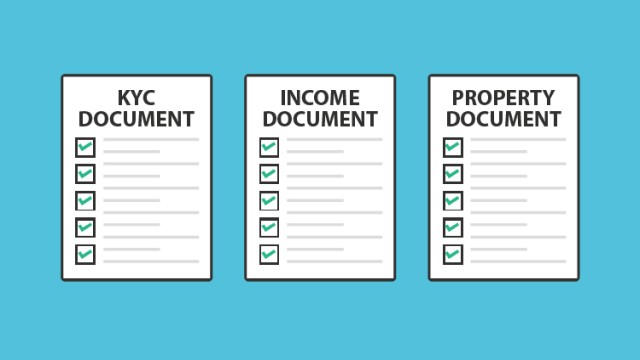

Home Loan Documentation:

Various types of documents are required to be submitted for a Home Loan Application:

Various types of documents are required to be submitted for a Home Loan Application:

♦ KYC Documents

♦ Income Documents

♦ Bank Statements

♦ Existing loan details

♦ Property Documents

Generally the documents required are almost similar across all Banks; however they may differ with various banks depending upon specific requirement etc.

Types of Interest Rates:

Fixed Interest Home Loan:-

Fixed Interest Home Loan:-

A Home Loan with a fixed interest rate means that the interest rate remains fixed throughout the given loan tenure irrespective of any changes in the Bank’s policies or RBI’s policy changes. The interest rate levied on the amount you borrow will be fixed or constant, irrespective of the financial market fluctuations and policy changes. However, LoanBroker.in do not advise their customers to opt for a Fixed Rate of Interest due to applicability of Foreclosure / Pre-payment charges on fixed rate home loan.

Click here to know about the latest Home Loan Interest Rates...

Floating Interest Home Loan:-

Most home loans in India are given as Floating or Adjustable interest rate Home Loan. In this, the interest rate is subject to change - increase or decrease based on Bank’s internal policies and RBI’s Monetary Policy norms. The interest rate is linked to a Benchmark rate like Base Rate or MCLR or Repo Rate and Margin or mark-up is added to this Benchmark rate to calculate the Effective Floating interest rate. The Benchmark rate is subject to change making the effective rate of interest varying or floating.

Although Floating interest rates seem more volatile in nature, they are still preferred as the most commonly used rate type. The primary reason for the same is NIL applicability of Foreclosure / Pre-payment charges on floating rate home loans.

Refer these Notifications of RBI wherein Floating Rate Term loans availed by Individual Borrowers do not attract Prepayment penalty:-

RBI Notification - Nil Prepayment Charges - Individual Home Loans

Click here to know about the latest Home Loan Interest Rates...

Home Loan Fees & Charges:

Acquiring a Home Loan doesn’t only involve the cost of home loan interest but it also includes other charges and fees at various stages of taking the Home Loan. You must consider all these charges while comparing the cost structure across banks. Following is the detailed fee structure incurred by banks at different loan stages:

Acquiring a Home Loan doesn’t only involve the cost of home loan interest but it also includes other charges and fees at various stages of taking the Home Loan. You must consider all these charges while comparing the cost structure across banks. Following is the detailed fee structure incurred by banks at different loan stages:

Before Loan Disbursement:

Processing Fees:

♦ It is a fee payable at the time of submitting the loan application to the bank, which is normally non-refundable. For salaried and corporate customers, it is usually limited to Rs.10,000 plus GST. For Self-employed, the fee ranges between 0.25% to 0.50% of the loan amount.

CERSAI Fees:

♦ CERSAI stands for Central Registry of Securitisation Asset Reconstruction and Security Interest of India. CERSAI is a central online mortgage registry of India. CERSAI was established to inspect mortgage frauds in which people take multiple loans against the same asset from different banks. Lenders have to register details of security interests created by them with the CERSAI, within 30 days of its creation. Hence, the home loan borrower is charged a nominal fee for this process as follows:

♦ For Loan amount up to Rs 5 lakh: Rs.50/-

♦ For Loan amount above Rs 5 lakh: Rs.100/-

Legal & Valuation Charges:

♦ Some Banks also charge the customer for legal assessment and technical valuation of the property. These are normally nominal and vary in few thousand rupees.

Administration Charges:

♦ A few Banks also charge administration fees. This is not included in the processing fee, and is non-refundable. These charges mostly include the lawyer fees, technical valuation charges and other verification expenses of Banks. All Banks have empanelled outsourced agencies for these valuations and verifications who are paid by the Banks for these reports. These reports are used to decide whether or not to sanction the loan.

Insurance Premium:

♦ Few Banks also insist Borrowers to get various types of insurances done like Property Insurance or Life Insurance. On most occasions the insurance premium is added to the loan amount itself which increases the EMI to a certain extent.

Franking charges:

♦ This is a State government charge like stamp duty fee which is nothing but a tax levied by the state government (State wherein the property is situated), on the amount of Loan taken. Only a few states in India levy this charge like Maharashtra, Karnataka, etc.

After Loan Disbursement:

Cheque Bounce charges:

♦ Banks charge between Rs.250-500 + GST for every bounced cheque towards the loan payment because of lack of funds in your account.

Delayed EMI Penal Interest charges:

♦ When there is a delay in the payment of your EMIs, Banks charge a Penal interest rate on the amount due which is much higher than the regular Home Loan interest rate, ranging from 2% to 3% of the amount due.

Fees for issuing statements, copy of documents etc:

♦ Asking for a Loan account statement, Repayment Schedule, Income tax certificate is Free of cost. However certain documents like Acknowledgement / List of original property documents, copy of property documents, copy of loan agreements, Principal outstanding letter etc. attract nominal charges which vary as per Bank / NBFCs.

Rate Conversion Fees:

♦ When the interest rates fall usually the benefit is passed on to the loan Borrower by reducing the interest rate. However in many situations you may find that your interest rate is higher than the prevailing interest rate. In such a case, you can negotiate the new rate of interest from your Bank / Lender by paying a Conversion Fees. This varies from a few thousand rupees to a percentage fee of upto 0.50% of the outstanding loan amount. You can also consider switching over your home loan to a new Bank at a much lower cost by doing a Balance Transfer.

Prepayment / Foreclosure Charges:

♦ When the borrower prepays the loan before the loan tenure, banks charge a penalty which can go upto 4% of the principal outstanding amount. Though part-prepayment by the borrower (to a certain extent) does not attract any charges. However, this is now governed by RBI and on Home loans availed by Individual Borrowers it is NIL with no lock-in-period. Which means there is no restriction with regards to the amount or time by which the Home loan can be prepaid by the Individual Home Loan Borrower.

RBI Notification - Nil Prepayment Charges - Individual Home Loans